Sairam Jalakam Devarajulu, a Blockchain Technology Expert, writes for Deccan Mirror about the role of cryptocurrency in a decentralized economy.

In the span of just over a decade, blockchain technology has evolved from an experimental concept to a foundational pillar of the modern digital economy. At the heart of this transformation lie three pivotal networks: Bitcoin, Ethereum, and Solana. Each represents a distinct technological breakthrough, addresses different economic needs, and underpins a growing ecosystem of decentralized applications. Here is a comprehensive examination of how these platforms work, their innovations, and the real-world use cases that define their relevance.

Bitcoin: Digital gold for a trustless age

Launched in 2009 by the pseudonymous developer Satoshi Nakamoto, Bitcoin was the first practical implementation of a decentralized currency. Created in response to the 2008 financial crisis, it offered a radical alternative to central banking: money governed not by institutions, but by cryptographic consensus.

Bitcoin is best understood as a store of value. Its fixed supply of 21 million coins, enforced by mathematical rules, positions it as a deflationary asset immune to monetary debasement. As inflation surged globally, Bitcoin became increasingly attractive to institutional and retail

investors seeking a hedge against currency risk.

The underlying technology is based on a Proof of Work (PoW) consensus mechanism. Every 10 minutes, miners compete to solve cryptographic puzzles; the winner appends a block of transactions to the blockchain and earns a block reward. This process, while energy-intensive, ensures immutability, transparency, and censorship resistance.

Proof of Work (PoW) is a mechanism that requires participants (miners) to perform complex mathematical computations to validate transactions. The “work” serves as a safeguard against spam and fraud, making it extremely difficult to tamper with transaction history.

Mining Bitcoin requires specialized ASIC hardware, substantial electricity, and network bandwidth. Though criticized for its energy consumption, proponents argue that Bitcoin’s security and neutrality are worth the trade-off.

Today, Bitcoin remains the most secure and decentralized blockchain currency. It does not support programmable contracts, but its simplicity is its strength, acting as a monetary base layer in the broader digital economy.

Ethereum: The programmable foundation of Web3

While Bitcoin redefined money, Ethereum, launched in 2015 by Vitalik Buterin and collaborators, redefined what a blockchain could do. Rather than serving solely as a ledger, Ethereum is a Turing-complete platform that enables developers to build decentralized applications (dApps) through smart contracts.

Smart contracts are self-executing programs that automate complex agreements without intermediaries. This innovation catalyzed the DeFi (Decentralized Finance) boom, the rise of NFTs (Non-Fungible Tokens), and the emergence of DAOs (Decentralized Autonomous

Organizations).

Ethereum originally operated on a PoW model but transitioned to Proof of Stake (PoS) in 2022 via a major upgrade known as The Merge. Validators now secure the network by staking 32 ETH, drastically reducing energy usage and increasing scalability.

Proof of Stake (PoS) replaces mining with staking. Instead of solving puzzles, participants lock up a portion of their cryptocurrency as collateral to validate transactions. This approach is more energy-efficient and encourages honest behavior by tying network participation to

economic risk.

Transactions are processed through the Ethereum Virtual Machine (EVM). While the base layer handles ~15–30 transactions per second (TPS), Layer 2 scaling solutions like Optimism and Arbitrum can handle thousands.

Ethereum’s Ecosystem Highlights:

- Uniswap: Peer-to-peer token exchange.

- Aave: Lending and borrowing protocol.

- OpenSea: Premier NFT marketplace.

Ethereum’s versatility and robust developer community make it the cornerstone of Web3 innovation.

Solana: Scaling the Blockchain for real-time use

As Ethereum grew, its limitations—notably high gas fees and network congestion—became apparent. Enter Solana, launched in 2020 by Anatoly Yakovenko. Solana was architected to provide internet-scale performance without sacrificing the core tenets of blockchain

decentralization.

Solana introduced Proof of History (PoH), a novel consensus mechanism that creates a verifiable sequence of time between transactions. Paired with Proof of Stake, this enables extremely fast throughput—up to 65,000 TPS in theory—with near-zero fees.

The chain is optimized for speed via Sealevel, a parallel execution engine allowing multiple smart contracts to run simultaneously. This makes Solana particularly appealing for applications requiring high frequency and low latency, such as gaming, payments, and decentralized exchanges.

Validators in Solana require powerful hardware but can be delegated stakes from users to increase network participation. Despite occasional network outages, the Solana Foundation continues to invest in enhancing infrastructure resilience.

Solana’s Flagship Projects:

- Magic Eden: Fast, user-friendly NFT marketplace.

- Jupiter: Decentralized exchange aggregator.

- Phantom: Wallet for staking, NFTs, and dApps.

Solana represents an aggressive push toward blockchain usability at scale, with a focus on user experience and performance.

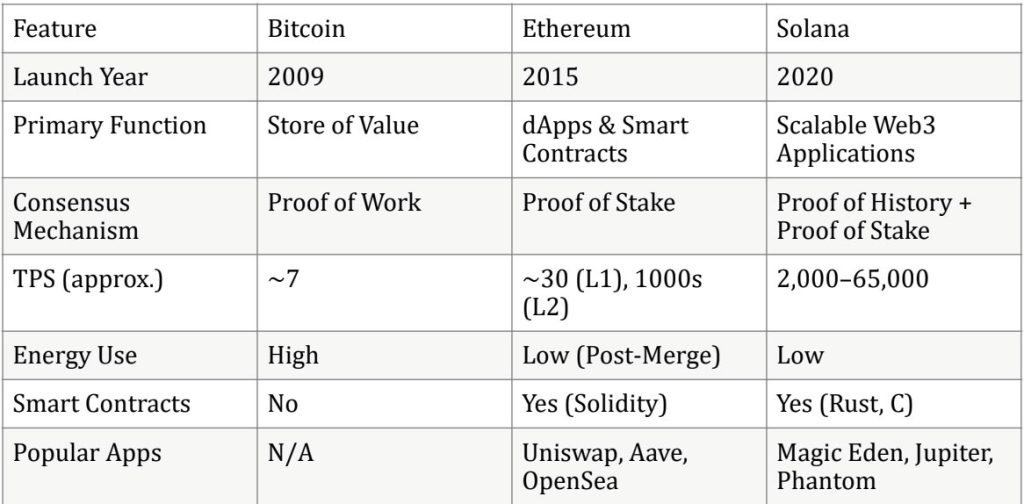

Comparative Framework

Conclusion

Bitcoin, Ethereum, and Solana each address unique dimensions of blockchain technology. Bitcoin offers monetary stability and security. Ethereum provides a programmable substrate for decentralized innovation. Solana aims to deliver the speed and scale required for real-time global applications.

Rather than competing for dominance, these platforms function as complementary layers in a maturing decentralized ecosystem. Together, they represent the trajectory of blockchain’s evolution: from digital money to digital economies, and ultimately, toward a decentralized internet.

As adoption accelerates across governments, institutions, and consumers, understanding the fundamentals of these technologies will be essential for navigating the future of finance, data ownership, and digital identity.